Instagram and beauty brands go together like primer and foundation: better together.

We studied top hair, makeup, skincare, and nail brands from Allure Magazine’s 2019 Best of Beauty Award list (along with a bunch of our team’s favorites) to put together the ultimate guide to successful beauty marketing strategies on social. With millions of consumers following and purchasing from these brands every day on social, we wanted to peel back the (face) mask and dive into the un(nail)polished truth about what makes top-performing beauty brands successful on Instagram, Facebook, and Twitter.

Read on for tons of stats and strategies to jumpstart your beauty brand’s social this year. And don’t forget to download the full rankings and our favorite top 10 beauty campaigns of the year.

Grab the beauty rankings and our top 10 campaigns.

Download the full reportOverall Top 10 Beauty Brands on Social Media

We saw some truly fantastic posts and campaigns from beauty brands this year. Let’s get into the brands that ranked highest across all three channels we studied.

Three cheers for our top 10 beauty brands!

Congratulations to Glossier, our overall winning makeup brand this year! This brand’s skincare and beauty products were a favorite across Instagram, Facebook, and Twitter (and definitely in our office!). Glossier’s performance was consistently in the top 10 across all three channels we studied, and most notably, their Instagram performance averaged 5x the median engagement we saw for other brands in the study.

| Overall Rank | Company | |||

|---|---|---|---|---|

| 1 | Glossier | 2 | 9 | 6 |

| 2 | Fenty Beauty | 4 | 2 | 2 |

| 3 | Huda Beauty | 1 | 12 | 17 |

| 4 | ColourPop | 5 | 4 | 4 |

| 5 | PIXI Beauty | 7 | 1 | 13 |

| 6 | Milk Makeup | 3 | 59 | 15 |

| 7 | Kylie Cosmetics | 10 | 10 | 8 |

| 8 | KKW Beauty | 18 | 5 | 7 |

| 9 | Beautycounter | 17 | 3 | 15 |

| 10 | Kaja | 12 | 40 | 18 |

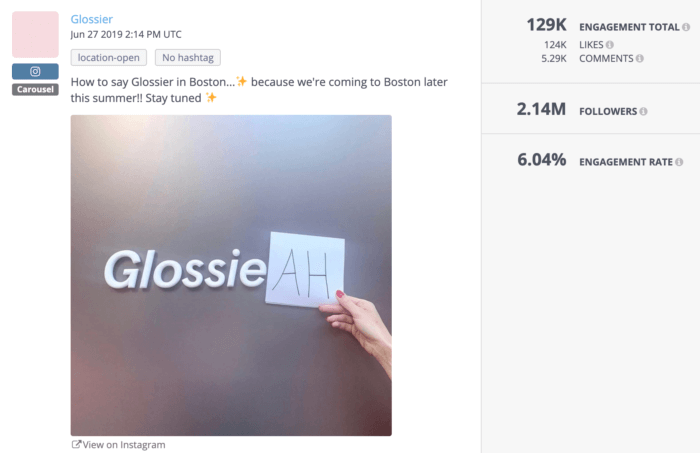

Followers loved their luscious product shots and hilarious memes, and posting about store openings also helped rocket Glossier to our top beauty brand of the year.

Fan favorite Glossier did a lot with a simple idea to announce their new Boston location.

The magic doesn’t come from highly produced photos or creative copy. Rather, Glossier is tapping into their rabid local fanbase and giving them what they want: more access to Glossier products.

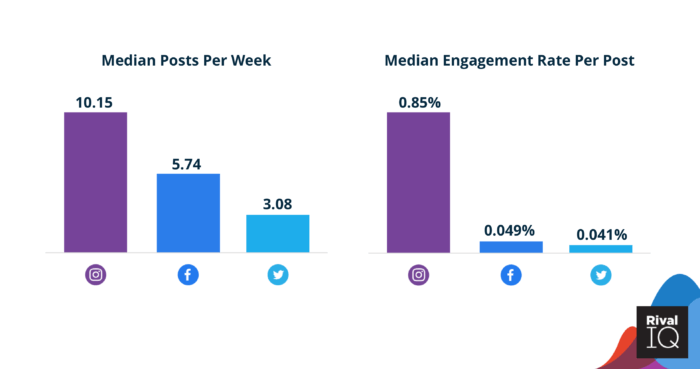

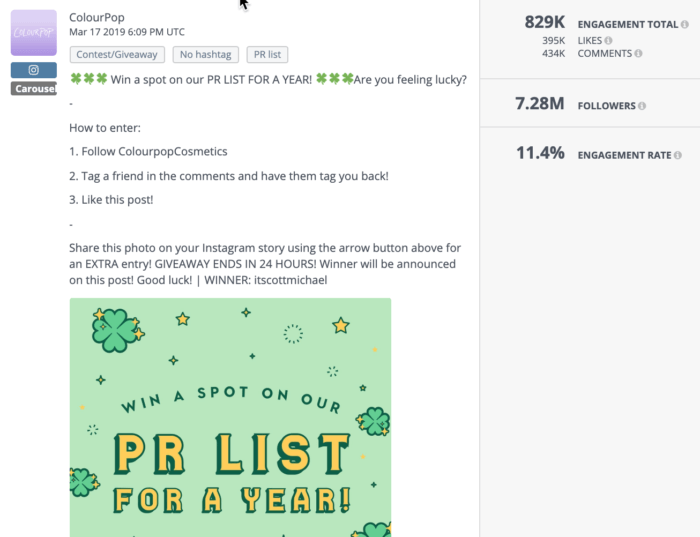

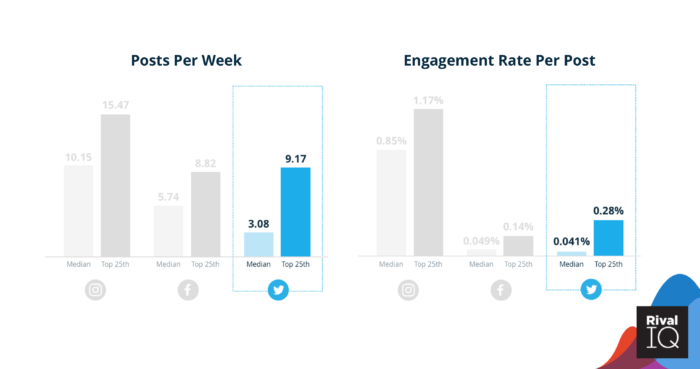

Here’s the tl;dr for median beauty engagement rates on social for these brands in case you can’t wait another minute:

- Instagram engagement rate: 0.85%

- Facebook engagement rate: 0.049%

- Twitter engagement rate: 0.041%

Median posts per week and engagement rates for beauty brands on Instagram, Facebook, and Twitter

We saw lots of awesome campaigns and posts from all 100 brands we surveyed, so let’s get into it.

Top Beauty Brands on Instagram

No surprises here that beauty’s favorite social channel was the ultra-visual Instagram judging by engagement rates. This channel is a really important player for beauty brands, especially as additional ways to engage like Stories and Shopping continue to rise in popularity. Beauty brand fans were more likely to engage with brands on Instagram than on Facebook and Twitter combined. Let’s get into what makes this channel especially engaging.

| Rank | Company | Posts / Week | Eng. Rate | Eng. / Post |

|---|---|---|---|---|

| 1 | Huda Beauty | 4.2 | 6.0% | 89,858 |

| 2 | Glossier | 7.7 | 2.6% | 52,548 |

| 3 | Milk Makeup | 14.0 | 2.4% | 35,844 |

| 4 | Fenty Beauty | 31.8 | 1.1% | 82,226 |

| 5 | ColourPop | 41.9 | 0.9% | 68,504 |

| 6 | Tatcha | 6.3 | 1.6% | 13,482 |

| 7 | PIXI Beauty | 10.4 | 1.1% | 11,734 |

| 8 | Kristin Ess | 4.0 | 1.9% | 10,106 |

| 9 | Thrive Causemetics | 9.9 | 1.8% | 4,521 |

| 10 | Kylie Cosmetics | 27.1 | 0.7% | 145,601 |

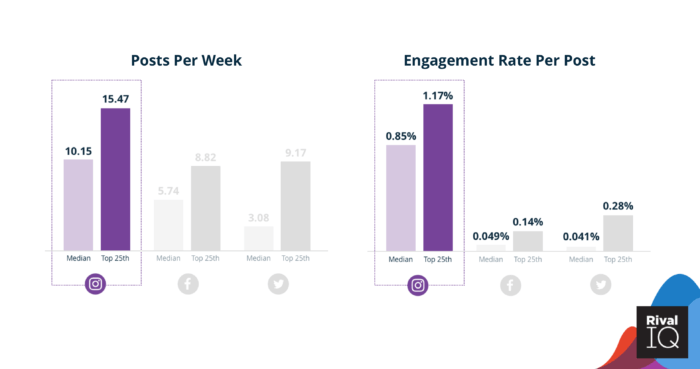

Instagram dominated in terms of posts per week and engagement rate this year for beauty brands.

Beauty brands saw median engagement rates 17 times higher on Insta than on Facebook or Twitter, and on average posted more often here than on the other two channels combined. As for the top 25%, we can’t all be winners, but a few brands went for the gold (eyeliner) on Instagram this year. These top brands’ engagement rates and posts/week averaged about 50% higher than the median.

Does high posting frequency guarantee you more engagement? The short answer is no. These brands found success not by carelessly sending out a few more posts at a time, but rather by finding what works for them and really going for it. Check out some of our top Instagram trends below to update your content strategy this year.

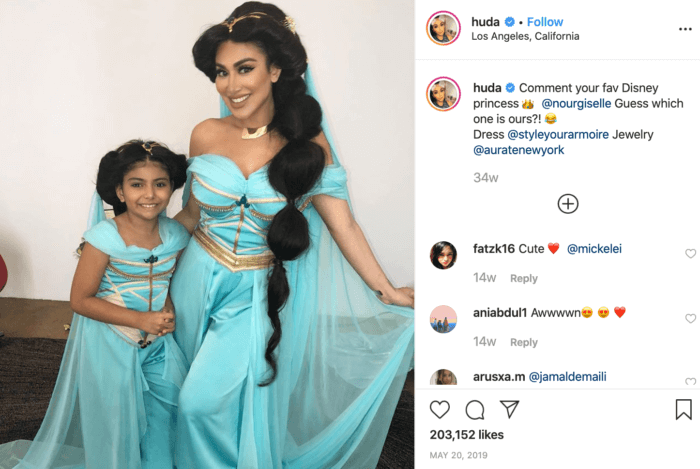

Huda Beauty won the gold on this ultra-competitive channel by keeping up with trending content and giving fans what they wanted: shots of founder Huda Kattan.

Huda Beauty’s Instagram followers loved her Aladdin-themed Instagram campaign.

With the launch of the Aladdin movie in May 2019, Huda Beauty founder Huda Kattan ran an Instagram campaign featuring images of her dressed as Jasmine that earned more than 2x the engagement of her average post. Followers loved images of her in the iconic costume, especially when paired with the story of how the original movie impacted her life.

Huda’s daughter lent a boost to these posts too–posts where she tags her daughter perform way above average.

Top Trend 1: Contests and giveaways

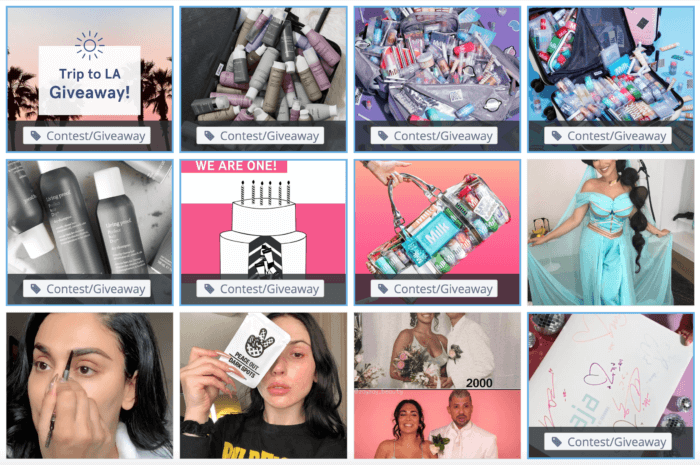

As with many industries, contests and giveaways are one of the most successful strategies right now to encourage your brand’s followers to engage with your post instead of just scrolling on by. A whopping 84% of companies surveyed are running contests and giveaways on Instagram, which means these contests are table stakes at this point for beauty brands. Seven of the top 10 beauty posts of the year on Instagram were contests or giveaways–wow!

Contests dominated the top 10 posts on Instagram this year.

Running a quick contest is low effort for your social team and can have a seriously positive impact on your brand’s bottom line in terms of engagement and follower growth. Beauty brands are giving away new products, box sets, or even travel and experiences in exchange for likes, follows, Story reshares, and tagging friends.

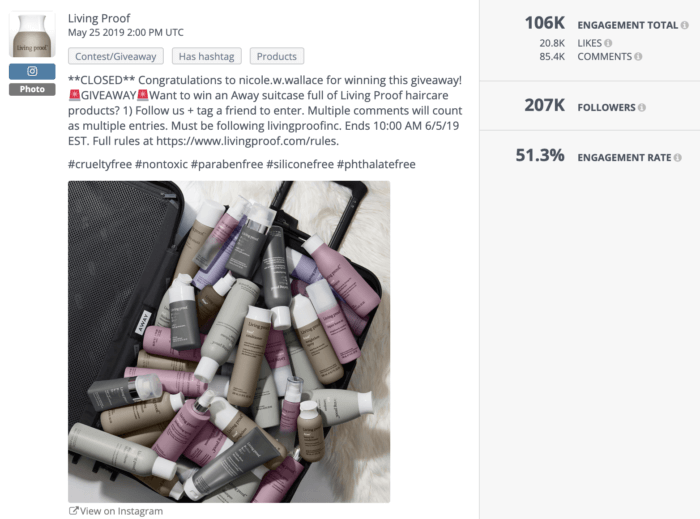

Check out the whopping 51% engagement rate on this Living Proof contest.

These posts are successful for a number of reasons, but let’s call out two. The first is that they ask explicitly for action on the follower’s behalf, and we see again and again that a little direction goes a long way towards improving social media engagement. The second reason is that followers check back on the post again and again to see if they’ve won until the brand releases the winner, which amplifies the number of impressions on the post.

If your brand isn’t already running contests periodically, try it out to see if you can stir your followers into a frenzy like these top brands.

Top Trend 2: Holidays

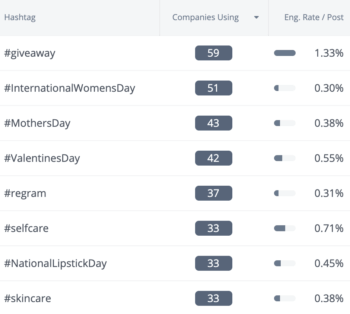

Beauty brands didn’t shy away from content about real holidays like birthdays, Mother’s Day, and Valentine’s Day, as well as made-up social media holidays like #nationallipstickday. Social media users love a good excuse to celebrate, even if it’s just National Cat Day (which we totally celebrated at Rival IQ). Nearly 90% of the brands we surveyed included some sort of holiday-themed content in their posts this year.

Some of the beauty industry’s most frequently used Instagram hashtags this year featured holidays.

Creating holiday-themed content, and especially using holiday hashtags, can help your brand break into what’s trending now. This hyper-current content has a better chance of being seen by followers as it picks up engagement steam. Tapping into the cultural zeitgeist also positions your content to be picked up in Instagram’s Explore tab, which serves trending content to users based on their interests regardless of the handles they’re following.

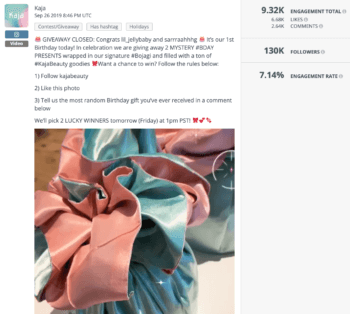

KAJA’s birthday post sought to capitalize on both holidays and contests to maximize engagement.

Many of these posts also feature contests/giveaways to try to piggyback on one of the most successful Instagram strategies of the year, like in the above post from KAJA Beauty. Don’t be afraid to combine strategies to see what works for your brand.

Top Trend 3: Ingredients

Consumers are growing more and more hungry for information on what’s in the products they’re buying. With “clean beauty�� on the rise, beauty brands are responding to calls from their customers to disclose their ingredients and make more of their products organic and natural.

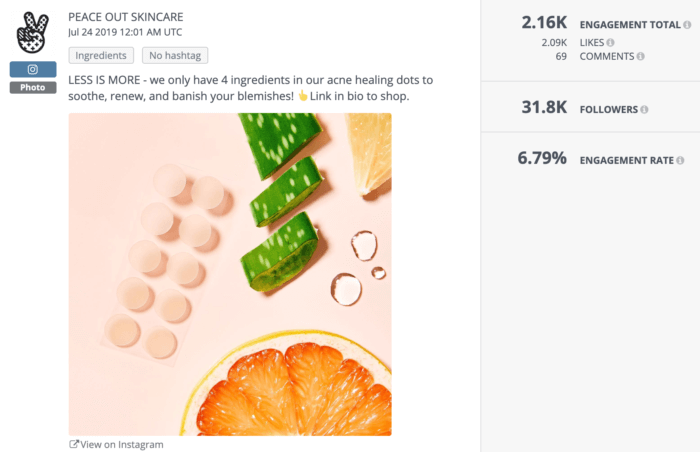

This short and sweet post from Peace Out Skincare put ingredients front and center without actually mentioning what’s actually in the product.

We used Post Tagging in Rival IQ to capture every time these brands mentioned any of these buzzwords in their posts this year. 93% of the companies we studied spoke about their products as being “natural” or “organic,” while 76% mentioned ingredients.

The vast majority of top beauty brands are including ingredient disclosure in their posts on Instagram.

While many beauty brands have hitched their wagons to the ingredients bandwagon, it’s interesting to note that these posts performed slightly below the 0.85% engagement rate median on Instagram.

Featured brand on Instagram: ColourPop

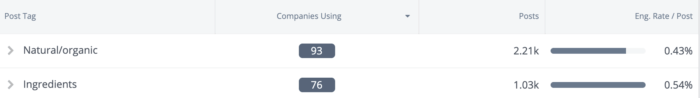

ColourPop took the year’s most popular strategy (contests) and turned it up to 11 by giving away a spot on their exclusive and ultra-popular PR list.

ColourPop’s followers couldn’t wait to enter their PR List contests.

For fans of ColourPop, receiving all the goodies in PR kits for a year is clearly good motivation to participate in these contests.

ColourPop’s top two posts of the year were PR list contest posts. In general, ColourPop’s contest posts do 4X better than their average post.

See how your posts stack up on Instagram.

Run a Free Head-to-Head ReportTop Beauty Brands on Facebook

Beauty brands were definitely active on Facebook this year even though this less-visual channel’s engagement couldn’t hold a 🕯to Instagram. Why? Contrary to Facebook, brands are still seeing relatively high reach on Instagram, and you can read all about it in our Instagram Stories Benchmark Report. In the meantime, let’s jump into what worked on Facebook this year.

| Rank | Company | Posts / Week | Eng. Rate | Eng. / Post |

|---|---|---|---|---|

| 1 | PIXI Beauty | 6.8 | 0.58% | 1,935 |

| 2 | Fenty Beauty | 5.6 | 0.32% | 1,907 |

| 3 | Beautycounter | 10.6 | 0.34% | 718 |

| 4 | ColourPop | 21.2 | 0.13% | 2,308 |

| 5 | KKW Beauty | 24.4 | 0.17% | 357 |

| 6 | Mary Kay | 6.3 | 0.11% | 3,559 |

| 7 | First Aid Beauty | 2.8 | 0.35% | 623 |

| 8 | COOLA | 7.5 | 0.25% | 174 |

| 9 | Glossier | 11.4 | 0.11% | 279 |

| 10 | Kylie Cosmetics | 18.5 | 0.06% | 2,429 |

With median brands posting just five times a week, brands were investing about half as much effort on Facebook as they were on Instagram.

Top beauty brands on Facebook saw about 3x the engagement as those in the middle of the pack and posted about 50% more often. These makeup and skincare brands put the “face” in Facebook by running contests and giveaways, strategically posting about different makeup types, and rocking the UGC. Let’s jump into the most successful beauty trends on Facebook this year.

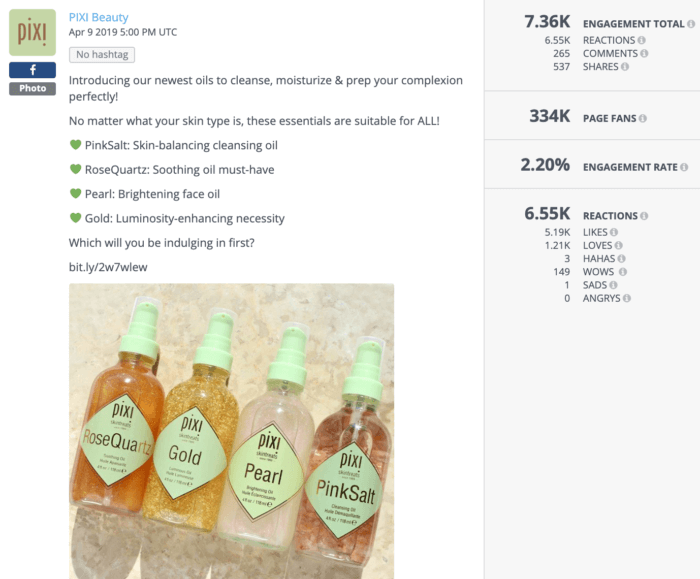

PIXI Beauty took the 🍰 on this channel with a radical strategy we didn’t see a lot of our other top brands using: showing off their products. While influencers, memes, and contests topping so many of our engagement charts, PIXI Beauty found success with simple, bright product shots and colorful copy.

PIXI Beauty’s fans loved this shimmering post about their face oils.

Top Trend 1: Contests/giveaways

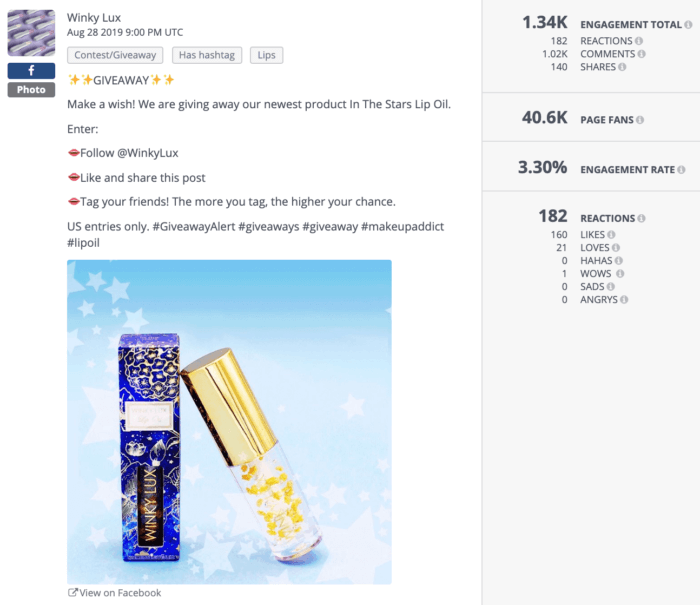

Just like on Instagram, contests and giveaways are common (and really successful) engagement strategies for beauty brands. Over half the companies we surveyed ran at least one contest or giveaway last year to the tune of 0.066% median engagement rate per post, which was well above the median Facebook engagement rate of 0.049%.

Winky Lux’s giveaway earned more than 70x the median engagement on Facebook.

Companies large and small are using this strategy on Facebook, and often pair it with product releases to draw attention to their latest offerings. These giveaways amplify engagement by encouraging followers to tag non-following friends and sharing the post, like in the Winky Lux giveaway post above.

Top Trend 2: UGC/Credited photos

Many beauty brands (more than half the brands on our list!) were all about giving credit where credit is due on Facebook this year in the form of UGC and photo credits. Crediting your photographer had a median engagement rate in line with our overall Facebook median engagement rate at 0.049%, but it’s worth noting that many of our top 10 Facebook posts this year included a credit or UGC tag.

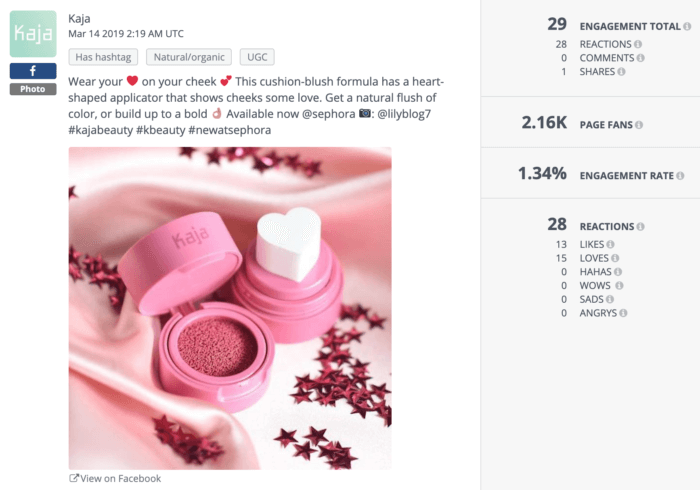

KAJA rocked a photo credit and some serious engagement on this product post.

Why so many 📸credits? In an influencer-heavy industry, tagging content creators amplifies the reach of a post by making it visible to their followers (and by nudging them to comment or share).

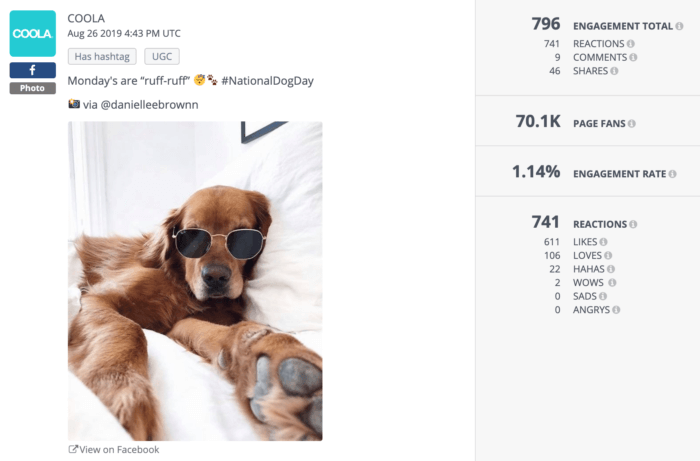

COOLA wasn’t above a good dog post to pup-peal to a wide range of followers. 🐶

In this world of memes and GIFs, photo credits are also helpful in sharing content your brand didn’t have a hand in, like this #NationalDogDay post from COOLA above.

Top Trend 3: Lip Service

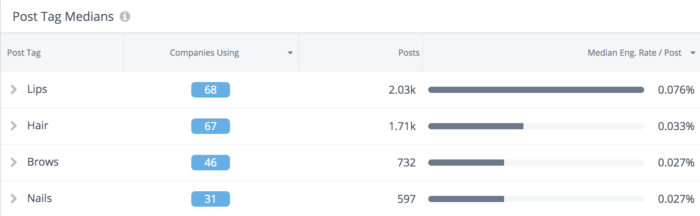

We used Post Tags to group content by makeup type for an instant head-to-head (or brow-to-brow). Every mention of lipstick, lip liner, and lip stains went into the “Lips” tag, while shampoo, conditioner, hair gel, and more went into the “Hair” tag, and so on. Which products fared the best on social?

Product mentions involving lips were the runaway favorite on Facebook.

With a median engagement rate of 0.076%, posts including lips and lip products perform far above the median engagement rate on Facebook, while nails and brows lag behind.

Lips are also posted about most often with more than 2,000 mentions, beating last-place nails by almost 4x.

Does this mean your nail polish brand should call it quits so you can start developing lip products instead? Definitely not. But brands with niche products should pay close attention to engagement rates and explore partnerships or influencers if you’re still not getting the results you want.

Featured brand on Facebook: KAJA Beauty

KAJA proved that contests and giveaways aren’t just for Instagram. With a Facebook engagement rate more than 4x the median, KAJA followers couldn’t get enough free stuff.

KAJA rocked with high-performing contests on Facebook this year.

The brand capitalized on the success of these posts by listing the winner in captions, which further incentivized post engagement by encouraging followers to check back on the post later to see if they’d won.

Top Beauty Brands on Twitter

Not to be left in the dust, Twitter’s median engagement rate was neck-and-neck with Facebook’s for beauty brands. We’re seeing the gap shrink between these two channels as Facebook’s engagement continues to lag. It’s worth noting that audience sizes are much smaller on Twitter as well. It may feel discouraging for brands to reach fewer people with every tweet, but since Twitter is perfect for 1:1 connections with your followers, smaller follower counts aren’t necessarily a bad thing.

| Rank | Company | Tweets / Week | Eng. Rate | Eng. / Tweet |

|---|---|---|---|---|

| 1 | Tresemme | 2.6 | 11.45% | 5,867 |

| 2 | Fenty Beauty | 11.1 | 1.36% | 5,738 |

| 3 | Pantene | 3.0 | 2.46% | 4,570 |

| 4 | ColourPop | 32.7 | 0.40% | 3,846 |

| 5 | Ole Henriksen | 3.8 | 2.40% | 503 |

| 6 | Glossier | 10.8 | 0.51% | 428 |

| 7 | KKW Beauty | 26.5 | 0.34% | 363 |

| 8 | Kylie Cosmetics | 30.4 | 0.10% | 774 |

| 9 | Beauty Bakerie | 38.8 | 0.16% | 172 |

| 10 | Anastasia Beverly Hills | 20.9 | 0.08% | 581 |

| 10 | Tarte Cosmetics | 33.4 | 0.07% | 604 |

Median posts/week and engagement rate/post on Facebook.

Beauty brands were posting least often on this channel with just three tweets/week on average, as compared to about six posts/week on Facebook and over 10 posts/week on Instagram. Leading beauty brands on Twitter saw almost 7x the engagement and were posting three times as often as median brands. It’s worth noting that these top brands on Twitter saw twice the median engagement that top beauty brands did on Facebook, suggesting once and for all that Twitter is definitely still worth putting resources towards. Here are a few ideas for making the most of your time on this channel.

This year’s top Twitter beauty brand, TRESemmé, had a unique advantage over their competitors: an affiliation with Korean pop sensation BTS, or the Bantan Boys. Nine out of ten of TRESemmé’s top-performing tweets featured or mentioned the pop stars, and judging by the 200% and 300% engagement rates, it was the equivalent of posting about the Beatles at Shea Stadium.

This great Twitter thread that TRESemmé retweeted was the most engaging tweet in our study.

TRESemmé’s success is yet another reminder that influencers and partnerships really matter to beauty consumers.

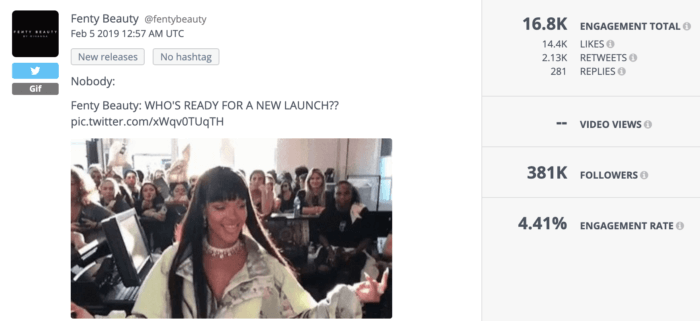

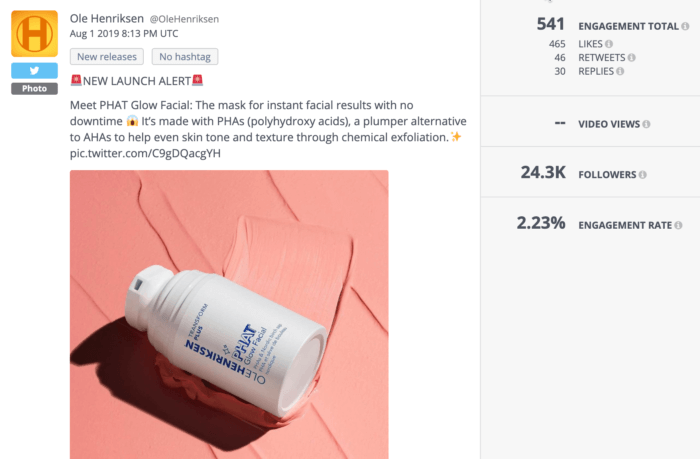

Top Trend 1: New releases

Twitter was a popular place for beauty brands to announce and connect with followers about new product releases this year. These posts averaged about 50% more engagement than the median, and naturally led to followers sharing their excitement or tagging their pals in comments.

Fenty Beauty didn’t even have to post about the actual new product to excite its Twitter followers.

These release tweets fell into two main camps: fun and meme-y announcements like the Rihanna GIF above, or more informational like the Ole Henrikson tweet below. Both are effective and engaging ways to remind your followers that your brand is doing new and awesome stuff.

Ole Henriksen stuck to the facts with their new face mask.

Twitter is an especially conducive channel for announcing product releases because you can include links to buy in-line. Even though the engagement is less than we see on Twitter, linking to your product helps your customers move through a seamless buying experience, which is always good for your bottom line.

Top Trend 2: Memes

No surprise here that two of the top 10 tweets this year were memes. This channel is especially well-suited for this viral, repostable content.

Briogeo’s Twitter followers loved this simple meme.

This post from Briogeo was the ninth most engaging tweet by engagement rate for beauty brands this year. What worked so well? It’s simple, funny, and very retweetable.

Featured brand on Twitter: Beautycounter

Beautycounter devoted almost a third of its tweets this year to its #betterbeauty campaign, which is all about making makeup more safe for consumers. From impassioned pleas to Congress to featuring their staff and supporters in action, Beautycounter used Twitter as a focused platform for their message about improving beauty standards.

Beautycounter focused their Twitter engagement this year on beauty activism.

Eight of their top 10 tweets this year featured Beautycounter’s activism on this topic and included the #betterbeauty hashtag. Their success reminds us if your brand stands for something, say it loud.

Check out the latest Social Media Industry Benchmark Report for even more benchmarks.

View the report nowHow is my beauty brand performing on social media?

Comparing your beauty brand’s performance on social has never been easier.

Browse our Live Social Media Benchmarks for a real-time look at top beauty brands’ posts, engagement rates, high-performing hashtags, and tons more. You can even add these benchmarks directly into your Rival IQ account for always-on monitoring of these top brands.

Need even more competitive analytics? Go head-to-head with a free report on Facebook, Instagram, or Twitter to see how you stack up against your top competition. See what makes your competitors tick with key insights and actionable advice you can start using now to come out on top.

If you’re hungry for even more stats, grab a free 14-day trial with Rival IQ.

See how Rival IQ can help top beauty brands.

Explore our beauty solutionsMethodology

We surveyed 100 beauty brands between January 1, 2019 and September 30, 2019 on Facebook, Instagram, and Twitter. We included a selection of brands from Allure Magazine’s 2019 Best of Beauty Awards and others from our team. Using this data and a weighted formula, we generated an overall engagement ranking for each beauty brand. The top-ranked beauty brands have high engagement rates with average or better audience size and posting volumes.

We define engagement as measurable interaction on social media posts, including likes, comments, favorites, retweets, shares, and reactions. Engagement rate is defined as the total engagement divided by audience size.

The case for benchmarking

Why benchmark instead of just measuring how your brand’s individual performance changes over time? Because social success is relative. Benchmarking means figuring out what’s working (and what isn’t) brands in your industry and measuring your success against that.

It’s really important to go beyond likes and favorites because audience size is hugely important: 200 likes is great engagement for a beauty brand with 1,000 followers but is a drop in the bucket to a brand with 100,000 followers. Engagement rate helps us take audience size into account to see who’s really reaching the highest percentage of their fans and followers with their social posts, which are the beauty brands you need to beat.

Wrapping it up

Beauty marketers, we hope this report gives you all the #inspo you need to shine brighter than Ansel Elgort’s glitter eyeshadow at the Golden Globes. There are plenty of successful strategies above to borrow or steal from your competitors (have we mentioned contests and giveaways?), so don’t be afraid to start experimenting to see what really resonates with your followers. And, of course, there’s no point in trying something new on social without measuring it 😉.

See the full rankings and top 10 beauty campaigns now.

Download the full report