A Slow Recovery for Newmont

Newmont Corporation (NYSE:NEM) released its first-quarter earnings on April 25. It was a significant quarter because the Newcrest acquisition was finalized on Nov. 6, 2023, so metals production fully reflects the merger's completion. Metal production included only partial production from Newcrest in the fourth quarter of 2023.

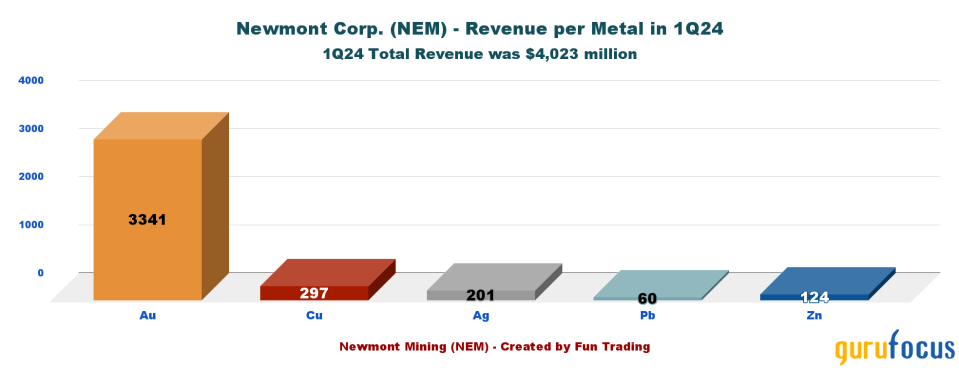

Most revenues in the first quarter came from gold, but copper and silver also contributed significantly.

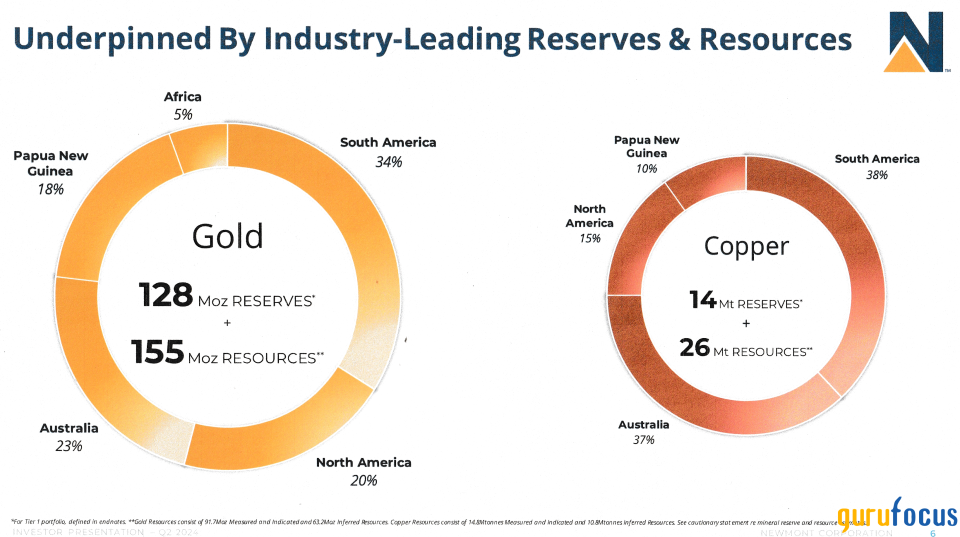

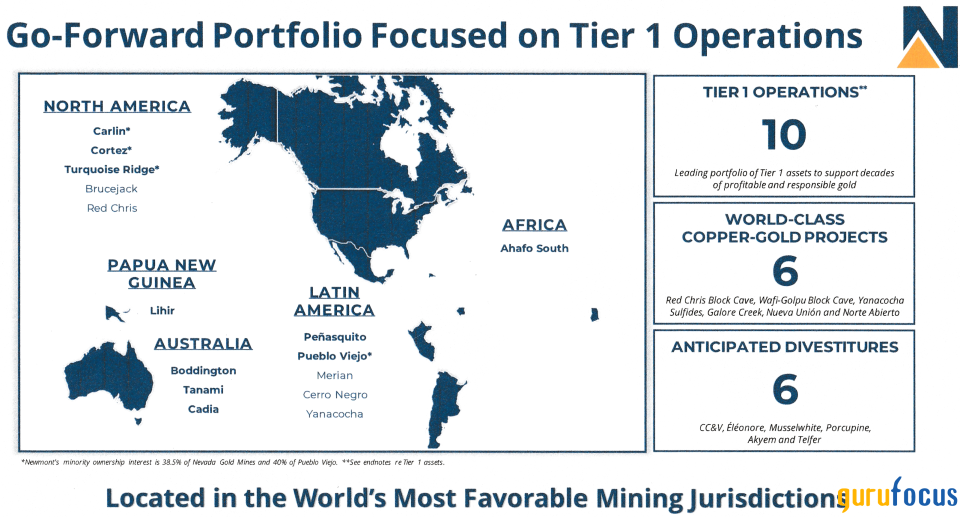

As a reminder, on Feb. 22, 2023, Newmont announced 2023 mineral reserves for the integrated company. Gold mineral reserves were 128 million ounces in 2023, up more than 40% year over year. One important element for long-term investors is 77% of the mineral reserves are in the Americas and Australia, which adds a premium component.

When comparing Newmont to Barrick Gold (NYSE:GOLD) and Agnico Eagle (NYSE:AEM), we can see Newmont holds the highest mineral reserves, which should be a sign of strength for the long term. Newmont has nearly the same gold reserves as the two companies combined. Barrick indicated 77 million ounces of gold, while Agnico Eagle indicated 53.80 million ounces.

Below are Newmont's proven and probable reserves from the presentation.

Another important factor is the outstanding diluted shares reached 1.15 billion, a 45% increase over the previous year, reflecting the full impact of the acquisition-induced dilution.

CEO Thomas Palmer said during the conference call, "We are firmly on track to deliver our 2024 guidance. We are pleased with our operational performance in the first quarter and remain focused on delivering consistent results as guided over the remainder of this year and beyond."

Regrettably, Newmont has been a major disappointment, and my long-term investment is still in the red. The stock has experienced a significant decline and has not been able to recover from the substantial losses of the past two years, despite the recent all-time high for gold. Four crucial issues emerged in 2023, significantly affecting the stock's performance.

The 120-day illegal labor dispute at Penasquito significantly impacted the stock, resulting in a loss of 100,000 gold ounces in the fourth quarter of 2023.

There were concerns about asset integrity at the Ahafo mine.

The wildfires in Canada had an impact on Eleonore.

The recent delay and extra cost of the Tanami project.

Thus, Newmont remains the worst performer year over year among my three long-term gold miners and two main exchange-traded funds, the iShares Silver Trust (SLV) for silver and the SPDR Gold Shares ETF (GLD) for gold.

Additionally, the company lowered its dividend payout from 40 cents to 25 cents per share in the previous quarter. The dividend yield stands at around 2.40%.

Despite the challenges and setbacks, I remain confident in Newmont and anticipate a strong performance of the stock in the latter half of 2024.

My analysis is rooted in the examination of the company's fundamentals, such as reserves and future production, in relation to the strength of the gold price. It is important to keep in mind that, as investors, we cannot influence the stock valuation, as it can fluctuate quickly due to unexpected events or economic changes.

On the other hand, investors can control how they approach and invest in stocks such as Newmont. As an experienced trader for many decades, I believe it is important to trade a portion of your position to benefit from short-term fluctuations regularly while keeping a significant part of your position for a potential major upward move later on. Therefore, trading LIFO for about 40% of your position using technical analysis is highly recommended.

First-quarter highlights

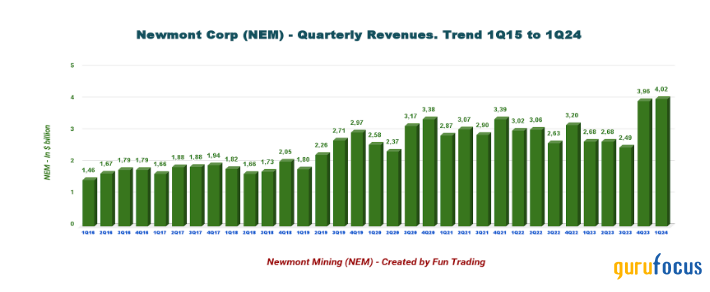

The earnings report for the first quarter was positive. Revenue exceeded expectations, reaching $4.02 billion, up from $2.68 billion the year prior.

During the conference call, Palmer said:

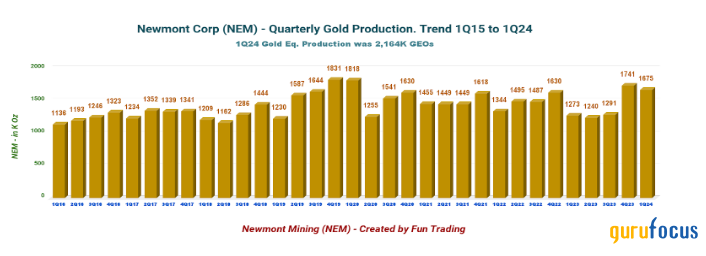

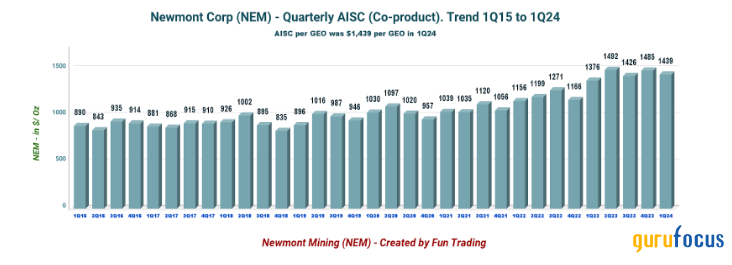

"With this sustainable foundation in place, we have created the industry's strongest portfolio of world-class gold and copper assets in the most favorable mining jurisdictions. And from this portfolio, we produced 1.7 million ounces of gold at an all-in sustaining cost of $1,439 per ounce in the first quarter. We continue to expect these unit costs to improve throughout the year, driven by both higher production in the second half and the delivery of synergies."

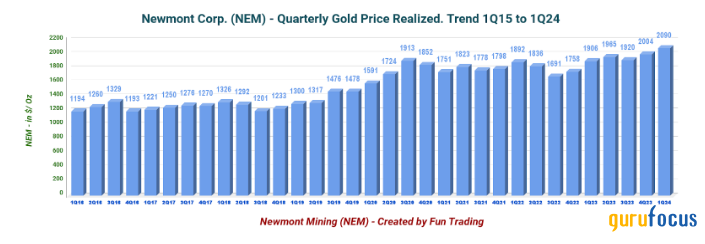

The comparison to last year is not highly relevant due to the inclusion of revenue from the Newcrest acquisition. However, it is anticipated that revenue in the second quarter will potentially increase by more than 10% as a result of the appreciation in gold and silver prices.

The net income stands at 15 cents per diluted share. However, the adjusted income is 55 cents per share, surpassing last year's 40 cents and beating analysts' predictions.

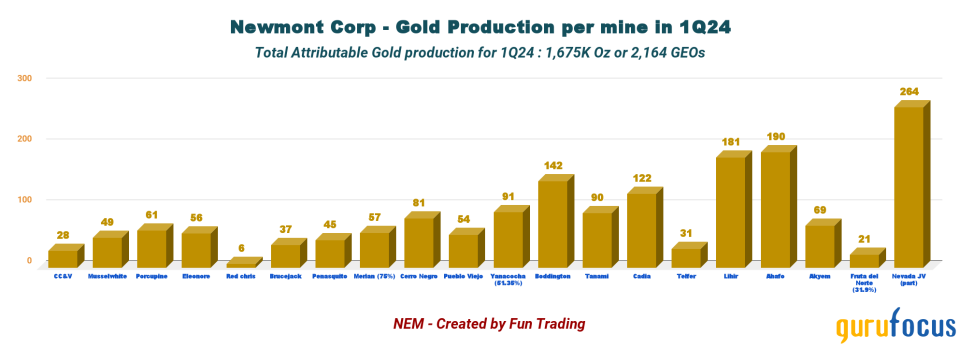

The first-quarter attributable gold production was 1,675,000 ounces, and the attributable gold equivalent production was 2,164,0000 GEOs. JV Nevada Gold Mines has produced 264,000 gold ounces, a decrease from 322,000 ounces in the fourth quarter of 2023. Nonetheless, production numbers have outperformed expectations.

Newmont is now producing from 19 mines, and the joint venturewith Barrick Gold is called Nevada Gold. The Fruta del Norte Mine (39.30%) is the latest addition. However, the company intends to divest about six mines in the near future: CC&V, Eleonore, Musselwhite, Porcupine, Akyem and Telfer.

Note: The map above is from the most recent Newmont presentation.

The all-in sustaining cost per gold equivalent ounce is still high at $1,439, but has stabilized and should decrease slightly in the second half of 2024. It would be more appropriate to reduce it to a range of $1,200 to $1,275, but it is not likely. Newmont projects gold production of approximately 6.9 million ounces in 2024. The company anticipates a cost of sales for gold at $1,050 per ounce and an AISC of $1,400 per ounce.

The gold production per mine is indicated below:

Newmont sold its gold production for a record $2,090 per ounce, compared to $1,906 in the prior-year period. Assuming an average gold price of $2,330 in the second quarter and a similar gold production quarter over quarter, revenue may increase by more than 11% next quarter, which will give the stock a boost.

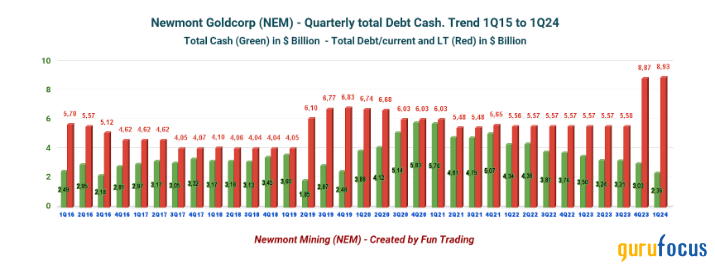

Liquidity decreased in the first quarter, with $2.36 billion of consolidated cash and approximately $7 billion in target liquidity. In the year-ago quarter, cash was $3.50 billion. The chart below illustrates a concerning trend in cash on hand, which may have contributed to the dividend reduction. The reported net debt-to-adjusted Ebitda ratio was 1.20, which is acceptable.

Finally, Newmont was once again unable to generate free cash flow. The free cash flow for the first quarter was a deficit of $74 million, and the free cash flow on a trailing 12-month basis is now $68 million. However, I expect a strong second quarter with sizeable free cash flow.

Technical analysis (short term) and commentary

Note: The chart has been adjusted for dividends.

Newmont forms an ascending channel pattern, with resistance at $44.20 and support at $40.65. The relative strength index is now 55, which is not very telling.

While an ascending channel is typically considered bullish in the short term, the pattern frequently ends with a breakdown, particularly if the gold price fails to hold support at $2,325.

The risk of a general retracement in the precious metals segment is linked to the future Federal Reserve's interest rate decision and when it will shift to a rate cut, which is widely expected before 2025.

Therefore, taking partial short-term LIFO profit is important, expecting a retracement to lower support, potentially below $40. As I explained earlier, the short-term trading strategy is to trade LIFO for approximately 40% of your position while holding a core long-term amount for a significantly higher payout.

I suggest selling between $43.70 and $45, with possible higher resistance at $46, and then waiting for a retracement between $41 and $40, with possible lower support at $37.80.

Warning: To remain relevant, the TA chart must be updated regularly.

This article first appeared on GuruFocus.